In the ever-evolving landscape of decentralized finance (DeFi), trust is paramount. However, a recent incident has sent shockwaves through the crypto community, as an individual closely associated with one of the most renowned DeFi platforms, Uniswap, has allegedly perpetrated an audacious rug pull on their own token project. The unfolding drama involves AzFlin, a developer at Uniswap, who launched the Frenstech token ($FRENS) only to trigger a cascade of disbelief, disappointment, and distrust.

Just hours after the token’s deployment, chaos erupted when evidence emerged that AzFlin had allegedly executed a rug pull, leaving investors high and dry. The developer’s actions reportedly saw the illicit transfer of a staggering 14 ETH from the Base chain back to his own wallet. As the blockchain community scrambled to make sense of this outrageous act, the saga took an even darker turn.

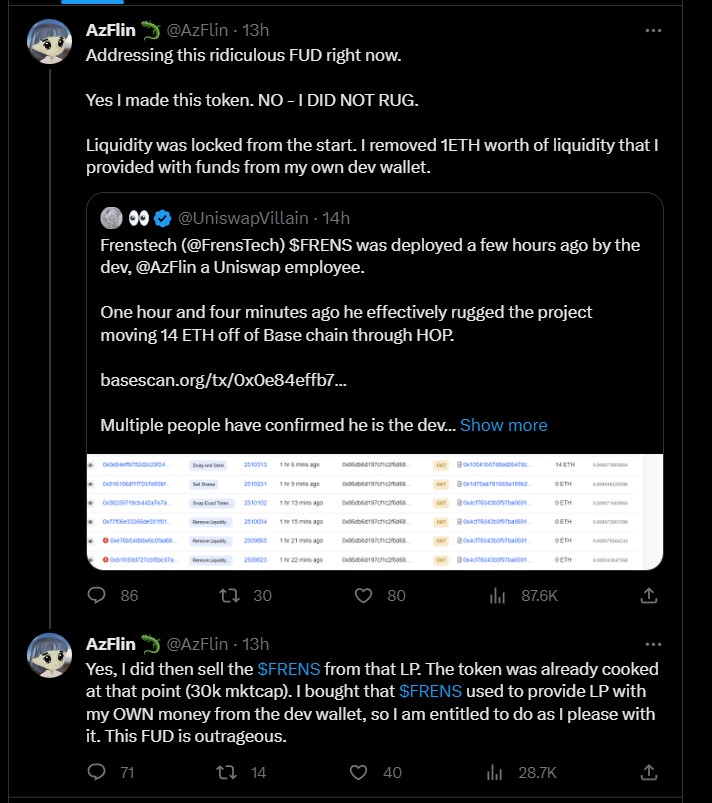

Proof of the developer’s involvement appeared irrefutable, with multiple sources corroborating AzFlin’s connection to Frenstech. The dev’s Twitter account, along with an army of early Uniswap employee followers, lent weight to the allegations. It was revealed that the liquidity added to the token’s project had been promptly removed, with the fees pocketed by AzFlin himself. To add insult to injury, the tokens extracted from the liquidity pool were promptly sold, compounding the financial blow to unsuspecting investors.

In a startling twist, AzFlin broke his silence to address the allegations head-on. His response, shared on his Twitter account, painted a different picture. According to AzFlin, liquidity had been locked from the project’s inception, and the removal of a small portion of it was justified by his personal investment using funds from his own developer wallet. He defended his actions as well within his rights, given the alleged state of the token’s market capitalization at the time.

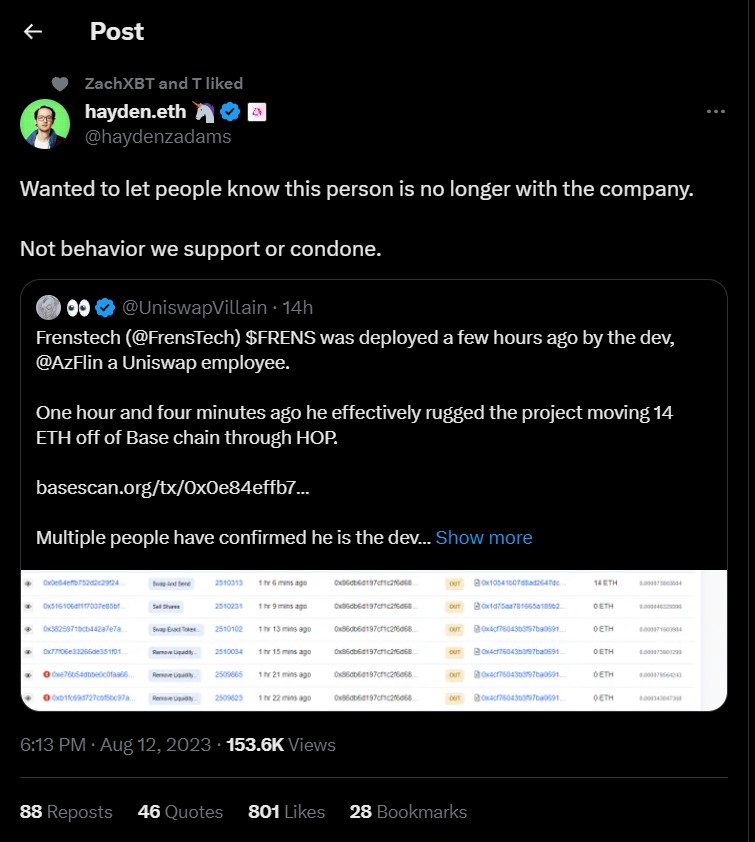

The ripple effect of this debacle extended even further, as one of the founders of Uniswap, Hayden, stepped forward to distance the company from AzFlin’s actions. In a concise tweet, Adams confirmed that AzFlin was no longer associated with the organization. The swift action taken by the Uniswap team aimed to underscore their commitment to integrity within the DeFi space and to distance themselves from any behavior that could tarnish their reputation.

As the DeFi community grapples with the aftermath of this incident, it serves as a stark reminder of the inherent risks and vulnerabilities that persist in the decentralized realm. The saga of AzFlin and the Frenstech token stands as a testament to the importance of vigilance, due diligence, and collective responsibility in the pursuit of a trustworthy and secure financial ecosystem.

The question that inevitably emerges is whether the incident is an isolated case or indicative of a more systemic issue within Uniswap’s ranks. By launching a token and exploiting the project for personal gain, the employee in question has ignited concerns that other colleagues might be harboring similar intentions. This potentially corrosive undercurrent must be promptly addressed to preserve Uniswap’s reputation as a beacon of trust in the DeFi arena.

Undertaking an internal investigation can serve multiple purposes. Firstly, it can ascertain the extent of any unethical behavior that might be taking place. Secondly, it can demonstrate the company’s commitment to maintaining a level playing field for all participants in the DeFi ecosystem. Thirdly, it can serve as a deterrent for potential wrongdoers within the organization.

GIPHY App Key not set. Please check settings